Mobile devices have become a banking channel for communication.

75 % of customer interactions with banks happen online or via mobile apps. We use mobile apps to easily check our balance, quickly transfer money, or take small loans out in the comfort of our home. A fun fact is that 28% of American customers have never even visited their bank’s branch because none of their banking activity required their physical presence.

Yet, although banks provide a lot of information through websites, apps, or emails, all these channels offer only one-way interactions that are missing the human touch. Without a personal approach, banks can’t create a sense of security, gain customers’ trust, or build long-lasting relationships. Fortunately, the fast development of conversational interfaces lets banks effectively automate customer communication without losing the benefits of personalized conversations.

What is conversational banking?

Conversational banking is a type of banking where customers handle banking operations while conversing with text or voice interfaces. This type of banking brings financial information to customers via channels they are already using.

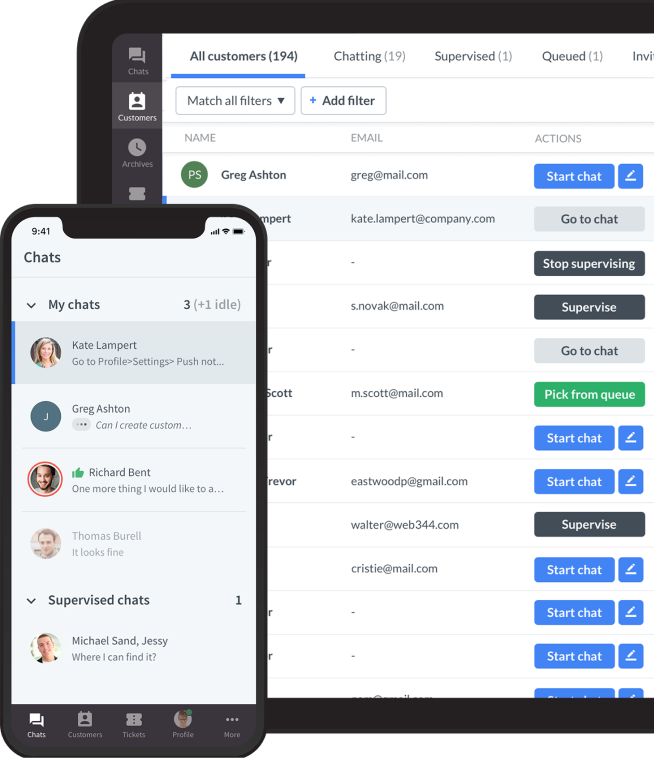

The difference between banking apps and conversational interfaces is that the latter doesn’t require users to learn their architecture, navigation, and terminology to perform banking operations. Chatbots are a conversational interface that can give customers a helping hand, and their usage doesn't require much effort from a user.

Interestingly, conversational banking can be also delivered in the form of automated sign language (ASL). This is a visual recognition of the sign language used by people with hearing impairments. Banks use it to translate a customer's statement into voice or text and to help them with self-service by using the bank's conversational interface.

The benefits of using banking chatbots

1. Support customers

Chatbots empower banks to help customers whenever they need it. They can answer questions regarding financial matters 24/7, help customers handle simple banking operations, or inform them where they can find the nearest ATM.

Apart from that, chatbots can function as personal banking assistants. They can support banking consultants in educating customers and making sure they understand all the banking processes they initiate. A chatbot can track how much customers spend and monitor other transactions. The advantage of this is that a bot can learn about customer’s spending habits and provide tips that support a customer’s financial wellbeing. Better educated customers make fewer mistakes and become more satisfied with the bank’s services in the long run.

2. Prevent fraud

Customer trust is the most important currency in the banking industry. It takes a lot of time to gain that trust, but it can be lost in seconds once a customer falls victim to fraud. The data shows that 22% of fraud victims close their bank accounts. On top of that, 14% of them complain about their negative experience on social media.

Banks know that they need to enhance security to save customer’s time and money, and their own reputation. This is where chatbots can help. AI chatbots can act as guardians of the customer's finances. They can keep an eye on a customer's banking activity and learn about trends in their expenditures. Because of that, a chatbot can detect unusual transactions on a customer’s account and warn them so that they can stop it immediately to prevent theft.

Moreover, banking chatbots enable customers to tackle issues in real-time and on their own. Take, for example, Erica, the smart assistant implemented by Bank of America. Erica allows customers to easily block their credit cards with a simple command. Customers can do it at any time of the day or night without contacting a human agent. By being able to react to issues immediately, they are given a sense of security.

3. Boost employee satisfaction

Call center consultants quickly get tired of answering the same questions all day. This affects their productivity, leads to mistakes, and lowers job satisfaction. Chatbots can help to prevent that. They can take over mundane customer questions and free up employees for more challenging tasks. Complicated financial issues keep customers awake at night, and, when agents resolve them, the customer's gratitude gives them a sense of accomplishment and motivates them.

4. Cross-sell and up-sell

Chatbots can monitor customer payments and transactions. This helps banks to cross-sell their financial products. For instance, when a customer buys a travel ticket, a chatbot can reach out to a customer proactively to offer them related products such as travel insurance or a foreign currency account.

Smart assistants powered by AI and deep learning algorithms can also analyze a customer’s activity and predict what type of products could help them manage their finances. The bot can recommend those products to a customer on a chat supporting conversion. Data shows that conversational banking can increase revenue growth by 25%.

5. Know customer tone and sentiment

Conversational interfaces enable banks to learn about customers' emotions and opinions. Thanks to NLP algorithms, chatbots can determine whether a customer is happy or angry. They can also pick up on sarcasm. This allows banks to easily find out what type of emotions are elicited by their products and services. To add to this, it lets them tailor chatbot responses to different customers’ moods, and address more issues on chat.

Make banking personal again

Banks no longer have to choose between scaling their banking services and delivering a personalized customer experience. Chatbots and voice assistants enable them to have their cake and eat it, too. When used wisely, conversational interfaces allow for creating a seamless digital customer experience and bringing the quality of back-office customer service online. Build better customer relationships. It’ll be worth it in the future.