It's the end of the month, and your VP of sales asked you for a monthly round-up of key sales metrics in your team. Since it's something you've never done before, your palms start sweating like you're B-Rabbit from 8 Mile.

What metrics do you look at? What formulas do you use to calculate all the key metrics? Find the answers to these and other mounting questions about sales analytics below, and stay calm and ready once and for all — not just on the surface.

What's sales analytics?

Sales analytics is the art and science of scrutinizing and deciphering sales-related data to gain valuable insights into your business's performance. It's not just about crunching numbers; it's about uncovering hidden patterns, understanding customer behavior, and making informed decisions to fuel your company's growth.

Why sales analytics matters for every business

Whether you're running a boutique store, managing a mid-sized company, or steering a corporate giant, sales analytics is your compass in the vast sea of commerce. In an era where data is king, it's the difference between navigating blindly and precisely steering your ship.

For small businesses, it means spotting opportunities, optimizing resources, and scaling efficiently. For larger enterprises, it's about fine-tuning operations, retaining customers, and outmaneuvering competitors. Sales analytics is the universal tool that bridges the gap between aspiration and achievement, and it's within your reach, regardless of your company's size.

On top of that, it offers invaluable insights into three key areas: sales performance, customer behavior, and the overall health of your business.

Sales performance insights

Imagine having a dashboard that shows you where your sales stand today and predicts where they'll be tomorrow. Sales analytics does just that. It provides a 360-degree view of your sales performance, highlighting your strengths and pinpointing areas that need improvement. With this data in hand, you can make informed decisions to boost revenue, optimize pricing strategies, and identify top-performing products or services.

Understanding customer behavior

Customers leave a trail of breadcrumbs, and sales analytics helps you follow that trail with precision. It allows you to track customer interactions, preferences, and purchasing habits. You'll know who your most loyal customers are, what drives their buying decisions, and how to keep them coming back.

By deciphering this data, you can tailor your marketing efforts, personalize the customer experience, and ultimately increase customer retention and satisfaction.

Overall business health check

Your business is a complex ecosystem; sales analytics acts as the physician, providing regular check-ups. It assesses the overall health of your operations by analyzing sales data and other critical factors like inventory levels, market trends, and economic indicators. This holistic approach allows you to make strategic decisions to ensure long-term sustainability and growth.

In a nutshell, sales analytics is your crystal ball, offering insights that transcend mere numbers. It empowers you to make data-driven decisions, seize opportunities, and mitigate risks. It's not just about improving your sales figures; it's about optimizing every facet of your business for success.

The four categories of sales analytics

Now that you know the significance of sales analytics, it's time to understand its four distinct categories.

Descriptive sales analytics

Descriptive analytics serves as your historical roadmap. It answers the question, "What happened?" By examining past sales data, you gain an understanding of your sales performance and trends. This category offers valuable insights into which products sold well, which regions were most profitable, and how your sales team performed in the past.

Diagnostic sales analytics

Diagnostic analytics acts as your detective, answering the question, "Why did it happen?" This category delves deeper into your data to identify the root causes of sales successes or setbacks. You can uncover patterns, correlations, and anomalies explaining why certain products thrived, why some regions underperformed, or why specific sales strategies yielded results.

Predictive sales analytics

Predictive analytics becomes your crystal ball, offering foresight into future sales trends. It addresses the question, "What is likely to happen?" By using advanced modeling and data analysis, predictive analytics forecasts future sales performance. This category can help you anticipate market shifts, customer behavior changes, and emerging opportunities.

Prescriptive sales analytics

Prescriptive analytics serves as your strategic guide, answering the question, "What should you do about it?" This category goes beyond prediction to recommend actionable strategies. It suggests optimizing sales processes, allocating resources, and tailoring sales strategies based on the insights gathered from descriptive, diagnostic, and predictive analyses.

The process of sales data analysis

This process is your roadmap to turning raw data into actionable insights, guiding your business to make informed decisions and drive growth.

Determine a sales metric to analyze

Your first task is to select a sales metric to analyze. This is the destination on your journey. Choose a metric that aligns with your current business objectives. Whether it's improving sales per rep, increasing sales by region, or optimizing lead conversion rate, defining your focus is crucial.

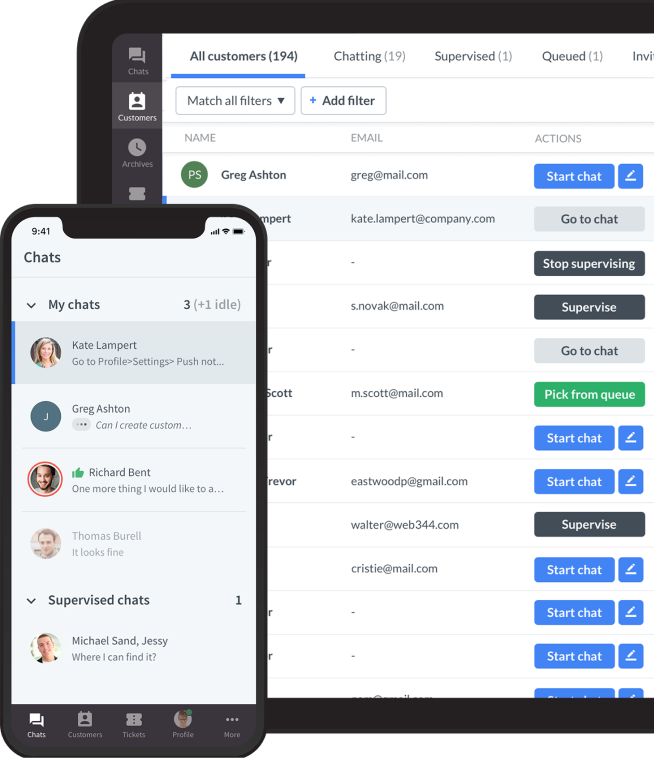

Collect data using various analytics tools

Once you've identified the metric to analyze, it's time to gather data. Sales data can come from a variety of sources, including your Customer Relationship Management (CRM) system, sales reports, and external data sources. Consider using analytics tools like Excel, data visualization software, or specialized sales analytics platforms to make this process efficient. These tools act as navigation aids, helping you collect, organize, and clean data for analysis.

Analyze the results

Now, it's time to navigate the data and discover insights. Use statistical analysis, data visualization, and reporting techniques to uncover patterns, trends, and correlations. Dive into the data with curiosity, looking for answers to questions like "Why did sales peak in this region?" or "What factors contributed to the decline in sales growth last quarter?" Remember that descriptive, diagnostic, and predictive analytics are valuable tools in this phase.

Apply findings to future initiatives

Your journey doesn't end with analysis; it's the starting point for action. Apply the insights you've gained to shape future initiatives. Consider expanding marketing efforts if you've discovered that a particular product is performing exceptionally well in one region. If you find a bottleneck in your sales funnel, take steps to address it. If predictive analytics indicate a future demand trend, prepare your inventory and sales strategies accordingly.

Communication and collaboration with your sales team and other relevant stakeholders are crucial throughout this process. Share your findings, collaborate on action plans, and use the insights to make informed decisions. Sales data analysis isn't just about numbers; it's about empowering your business to adapt, grow, and thrive.

Key sales metric

Average Order Value (AOV)

AOV is a metric that tells you the average amount a customer spends each time they make a purchase from your business. Understanding AOV is crucial because it offers insights that can significantly impact your revenue without acquiring more customers.

How to calculate AOV

To calculate AOV, simply tally up the total revenue generated from all orders within a specific time frame (for instance, a month) and divide it by the total number of orders during that period.

Why AOV matters

- Revenue boost: Increasing your AOV can boost your overall revenue. This can be achieved through upselling, cross-selling, or offering bundles and discounts that encourage customers to spend more.

- Marketing optimization: AOV helps you refine your marketing strategies. You can tailor your campaigns to target customers more likely to make larger purchases, maximizing your return on marketing investments.

- Inventory management: Knowing your AOV can also aid in inventory management. You can stock items accordingly, ensuring you have enough products that contribute most to your AOV.

- Customer segmentation: AOV can be used to segment your customer base. High-AOV customers may require a different approach compared to low-AOV customers. Tailoring your customer service and engagement strategies accordingly can enhance customer satisfaction and loyalty.

- Profitability: It's not just about increasing sales; it's about maximizing profitability. By focusing on higher AOV, you can potentially increase your profit margins.

The key to leveraging AOV effectively is not just to increase it blindly but to do so while delivering value to your customers. Offering products or services that genuinely enhance their experience can lead to higher AOV and happier, more loyal customers.

Customer Lifetime Value (CLV)

CLV is a metric that holds the key to predicting the value a single customer can bring to your company over the course of their relationship with you. It's an indispensable compass for businesses seeking to maximize customer retention and revenue generation.

How to calculate CLV

Calculating CLV can be as straightforward as it is enlightening. To get started, follow these steps:

- Calculate Average Purchase Value (APV): This is the average amount a customer spends on each transaction. Simply divide your total revenue by the number of transactions over a specific time frame.

- Calculate Average Purchase Frequency (APF): Determine how often, on average, a customer makes a purchase during that same time frame.

- Calculate Customer Value (CV): Multiply APV by APF to get the Customer Value.

- Determine Average Customer Lifespan (ACL): How long does the average customer stay engaged with your business? Calculate this by considering the duration of the customer relationship.

- Finally, calculate CLV: Multiply CV by ACL, and you'll have your Customer Lifetime Value.

Why CLV matters

- Customer-centric approach: CLV shifts your focus from short-term transactions to building long-lasting, profitable customer relationships. It encourages businesses to prioritize customer satisfaction and loyalty.

- Marketing investment allocation: By knowing the potential value of a customer over their lifetime, you can allocate your marketing resources more effectively. High CLV customers may warrant higher acquisition costs because they're likely to bring in more revenue in the long run.

- Product and service enhancement: Understanding CLV can guide product and service development. By knowing which customer segments have higher CLVs, you can tailor your offerings to meet their needs and preferences.

- Retention strategies: CLV highlights the importance of retaining customers. Keeping existing customers happy is often more cost-effective than constantly acquiring new ones.

- Profitability: Businesses with a high CLV often enjoy higher profitability. It's not just about revenue; it's about maximizing the value generated from each customer.

Incorporating CLV into your sales analytics toolkit is like having a crystal ball for predicting your business’s financial health and growth potential. You'll chart a course toward long-term success by focusing on nurturing and retaining customers.

Customer Acquisition Cost (CAC)

This metric reveals the investment required to acquire a new customer, allowing you to make informed decisions about your marketing and sales strategies. CAC is your guiding light for optimizing the efficiency and sustainability of your customer acquisition efforts.

How to calculate CAC

Calculating CAC involves summing up all the costs of acquiring new customers within a specific time frame. Here's a breakdown of the steps:

- Calculate marketing and sales expenses: Add up all the costs incurred in marketing and sales efforts, including advertising, promotional campaigns, and salaries of sales and marketing teams.

- Determine the number of new customers acquired: Count the number of new customers gained during the same time frame.

- Calculate CAC: Divide the total marketing and sales expenses by the number of new customers acquired during that period.

Why CAC matters

- Resource allocation: CAC helps you allocate your resources efficiently. It provides clarity on which marketing channels or campaigns are the most cost-effective in acquiring new customers.

- ROI assessment: Knowing the CAC allows you to assess the return on investment (ROI) for your customer acquisition efforts. Are you spending more to acquire a customer than they bring in as revenue over their lifetime (CLV)? CAC helps you find that balance.

- Scaling strategies: As your business grows, you can use CAC data to determine whether scaling your customer acquisition efforts is financially viable. It prevents overextending resources in pursuit of new customers.

- Budget planning: CAC plays a crucial role in budget planning. It enables you to set realistic budgets for marketing and sales, ensuring that your expenses align with your growth objectives.

- Pricing strategy: CAC can inform your pricing strategy. If your CAC is high, you may need to adjust your pricing to ensure profitability.

A lower CAC is generally favorable, but balancing this with other metrics like CLV is essential. Striking the right equilibrium between acquiring customers efficiently and maximizing their long-term value is the key to sustainable growth.

Monthly Recurring Revenue (MRR)

This metric is paramount for subscription-based businesses, SaaS companies, and anyone offering products or services with recurring billing. MRR serves as a compass, providing insights into the predictable revenue stream your loyal customers generate.

How to calculate MRR

MRR is calculated by adding up the recurring revenue generated from all active customers within a specific month. It includes subscription fees, service charges, or any other recurring revenue sources.

Why MRR matters

- Financial predictability: MRR provides a predictable baseline of revenue, making it easier to forecast your business's financial health and growth potential.

- Performance monitoring: Tracking MRR over time allows you to assess the effectiveness of your customer retention strategies. Are you keeping existing customers engaged and subscribed?

- Pricing adjustments: MRR data can inform pricing adjustments. By analyzing MRR growth or decline, you can gauge the market's response to changes in your pricing strategy.

- Investor attraction: For startups and growing businesses, MRR is a metric that can attract investors. It demonstrates the sustainability and scalability of your business model.

- Subscription model optimization: If you're in the subscription business, MRR data can guide decisions regarding plan offerings, upsells, and cross-sells.

Remember that MRR isn't just a static number; it's a dynamic indicator of your business's health. Whether you're a subscription-based service or not, understanding MRR and its growth trajectory is pivotal for making data-driven decisions that propel your business forward.

Annual Recurring Revenue (ARR)

Much like MRR, ARR is a vital metric for companies with subscription models, offering insights into the annual value generated by your loyal customers. It's a valuable tool for understanding your business's long-term revenue potential.

How to calculate ARR

ARR is calculated by adding up all the recurring revenue generated from active customers within a year. It encompasses subscription fees, service charges, or any other sources of recurring revenue over a 12-month period.

Why ARR matters

- Long-term financial planning: ARR provides a clear picture of your business's annual revenue stream. This helps in long-term financial planning and forecasting, ensuring stability and growth.

- Investor confidence: For startups and growing businesses, ARR can be an attractive metric for investors. It demonstrates a predictable and scalable revenue model, enhancing investor confidence.

- Subscription model optimization: ARR data can inform decisions about optimizing subscription plans, pricing strategies, and upsell opportunities to maximize annual revenue per customer.

- Market expansion: Monitoring ARR growth or decline can signal the effectiveness of your expansion efforts into new markets or customer segments.

- Customer retention focus: Keeping track of ARR can serve as a reminder to prioritize customer retention efforts. Maintaining or increasing ARR often depends on keeping existing customers satisfied and engaged.

ARR complements MRR by providing a broader view of your annual revenue. It's a compass that ensures you navigate your subscription-based business toward profitability, growth, and sustained success.

Sales growth

This metric is a fundamental indicator of your business's health, showcasing the rate at which your revenue increases over time. Understanding and monitoring sales growth is pivotal for assessing the effectiveness of your sales strategies and overall business performance.

How to calculate sales growth

Calculating sales growth involves comparing your current revenue with revenue from a previous period, typically a month, quarter, or year. The formula is as follows:

Why sales growth matters

- Performance assessment: Sales growth is an instant barometer of your business's performance. Are you moving in the right direction, or is there room for improvement?

- Goal tracking: It helps you track progress toward your sales goals and objectives. The metric keeps you accountable for your business's financial targets.

- Market responsiveness: Sales growth can signal how responsive your business is to market changes and customer demands. Rapid growth may indicate successful adaptation.

- Investor attraction: Investors are often drawn to businesses with consistent and impressive Sales growth figures. It demonstrates the potential for financial returns.

- Decision-making: Understanding sales growth is crucial for making data-driven decisions. It can guide resource allocation, expansion strategies, and marketing efforts.

- Competitive advantage: Consistent sales growth can help your business gain a competitive edge. It may signify that you're outpacing competitors in your market.

Sales growth is about increasing revenue sustainably and profitably. Rapid but unsustainable growth can lead to problems down the road, so it's essential to analyze the factors contributing to sales growth and ensure that they align with your long-term business objectives.

Lead conversion rate

This metric is paramount for assessing the effectiveness of your sales and marketing efforts in turning leads into paying customers. Understanding and monitoring lead conversion rate is pivotal for optimizing your sales funnel and achieving sustainable growth.

How to calculate the lead conversion rate

Calculating the lead conversion rate is straightforward. It involves comparing the number of leads that successfully convert into paying customers to the total number of leads generated. The formula is as follows:

Why the lead conversion rate matters

- Efficiency assessment: Lead conversion rate is a fundamental metric for assessing the efficiency of your sales and marketing efforts. It reveals how effectively you're moving potential customers through the sales funnel.

- Sales funnel optimization: A low conversion rate can signal bottlenecks or inefficiencies in your sales funnel. Monitoring this metric helps you identify areas for improvement.

- Resource allocation: It guides resource allocation by helping you allocate time, budget, and human resources to the most effective lead generation and conversion strategies.

- Sales forecasting: By understanding your lead conversion rate, you can make more accurate sales forecasts and set realistic growth targets.

- Return on investment: Knowing the conversion rate allows you to assess the ROI of your marketing campaigns and sales strategies. Are your efforts yielding results?

- Customer Acquisition Cost: It's closely tied to CAC. A high conversion rate can offset higher acquisition costs by maximizing the value of each lead.

- Lead quality assessment: It helps distinguish between high-quality and low-quality leads. High conversion rates often correlate with leads more likely to become long-term customers.

The lead conversion rate isn't just a single number; it's a dynamic metric that different marketing channels, campaigns, or customer segments can segment. Analyzing these segments can provide deeper insights into the effectiveness of specific strategies and allow you to fine-tune your lead generation and conversion efforts.

Sales funnel performance

This metric is pivotal for understanding how effectively your sales process is operating and where improvements can be made. Monitoring and optimizing sales funnel performance is essential for achieving higher conversion rates and revenue growth.

Understanding the sales funnel

Before we dive into how to measure and improve sales funnel performance, let's first clarify what a sales funnel is. The sales funnel represents the stages that potential customers go through before purchasing. These stages typically include awareness, interest, consideration, and conversion (purchase).

How to measure sales funnel performance

Sales funnel performance is assessed by tracking the movement of leads or prospects through each stage of the sales funnel. The key metrics to monitor include:

- Conversion rate at each stage: This measures the percentage of leads that move from one stage to the next. For example, from "awareness" to "interest" and so on.

- Time to conversion: How long does it take, on average, for a lead to progress from the initial stage to conversion?

- Drop-off rates: Identify the stages where leads are dropping off the most. High drop-off rates indicate potential issues that need addressing.

- Sales velocity: This metric assesses how quickly leads move through the funnel, providing insights into sales cycle efficiency.

Why sales funnel performance matters

- Optimization: Monitoring the sales funnel allows you to pinpoint areas for improvement. By addressing bottlenecks or weak points, you can optimize the funnel for better conversion rates.

- Predictive insights: Understanding how leads move through the funnel helps you predict future sales and make informed resource allocation decisions.

- Budget allocation: It guides marketing and sales budget allocation by identifying which stages or channels are most effective at converting leads.

- Customer journey mapping: Sales funnel data aids in mapping the customer journey, enabling you to create more targeted and effective marketing campaigns.

- Sales process refinement: Sales teams can use funnel data to refine their sales processes, tailor their approach to different stages, and provide more personalized customer experiences.

Sales target

This metric represents the revenue or sales objectives your business aims to achieve within a defined period, often a month, quarter, or year. Understanding and monitoring sales targets is essential for setting clear goals, tracking progress, and motivating your sales team to reach their full potential.

Setting sales targets

Setting sales targets involves defining specific, measurable, and achievable objectives. Sales targets can be based on various factors such as historical performance, market trends, growth projections, or a combination of these. They serve as a compass, providing a clear direction for your sales efforts.

How to measure sales targets

Measuring sales targets is straightforward. It involves comparing your actual sales or revenue to the predefined targets set for a specific period. The formula is as follows:

Why sales targets matter

- Goal setting: Sales targets set clear, tangible objectives for your sales team. This fosters motivation, focus, and a sense of purpose among sales representatives.

- Performance measurement: Monitoring sales target achievement provides a straightforward way to assess your team's performance against predefined goals.

- Resource allocation: It guides resource allocation by helping you assess whether you have the right sales strategies, workforce, and marketing efforts in place to meet your targets.

- Budget planning: Sales targets are crucial in budget planning, ensuring that you allocate the necessary resources to achieve your revenue objectives.

- Market adaptation: Sales targets may need adjustments if market conditions change. They serve as a compass that can be recalibrated to align with evolving business dynamics.

- Team accountability: Sales targets encourage accountability within the sales team. Each member can track their individual contributions to the overall sales goal.

- Motivation and recognition: Achieving sales targets is a cause for celebration and recognition. It motivates your sales team to perform at their best.

Sales targets are not static; they can evolve as your business grows or encounters market shifts. Whether you're setting targets for individual sales reps or the entire sales team, using them as a compass ensures that everyone is moving in the same direction, driving your business toward its revenue objectives.

The significance of sales analytics

Sales analytics is the key to unlocking a treasure trove of insights that can transform your business. It empowers you to understand your sales performance, customer behavior, and overall business health.

Remember that sales analytics is a dynamic journey, not a one-time event. The insights you gain will evolve with your business, and your strategies should evolve along with them. By using your newfound knowledge as a compass and taking actionable steps, you can chart a course toward improved sales performance, increased revenue, and sustained business growth.