Showing top 0 results 0 results found

Showing top 0 results 0 results found

According to Investopedia, churn rate, also known as attrition rate, “Is the rate at which customers stop doing business with an entity. It is most commonly expressed as the percentage of service subscribers who discontinue their subscriptions within a given time period. It is also the rate at which employees leave their jobs within a certain period. For a company to expand its clientele, its growth rate (measured by the number of new customers) must exceed its churn rate.”

Even though the churn rate isn't the only metric that will help you monitor your business, it’s one of the more reliable ones. When something goes wrong, your churn will reflect that almost immediately.

Calculating churn rate is not only for companies that are looking to fix their growth problems. If your net number of customers keeps growing, you can still use this metric to check and see if you could be growing faster.

Get it right, and your revenue will skyrocket.

Get it wrong, and you’ll spend time and resources just to keep the current number of customers.

What is a churn rate?

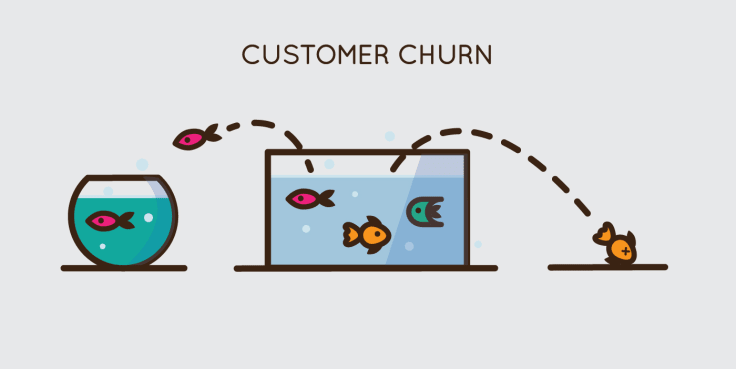

Churn rate is a metric that shows the percentage of customers you lose when their subscription expires or they stop using your product. Calculating customer churn rate is crucial to check the health rate of your business.

Imagine you had 1000 customers at the beginning of May. Fifty of those customers will churn for different reasons. This leaves you with a customer churn rate of 5%. Do the math again next month. This time, you’ll use the new number of customers, including everyone who subscribed in May. Later, check the number of accounts that expired and canceled and calculate the churn rate for June.

Keep tabs on the churn rate to make sure your business is doing fine. By doing this month after month, you can track any changes in the churn rate. You'll find out if you’re experiencing any problems and if the solutions you used to combat them are working.

When your churn rate goes up, it’s time to revisit your strategy and check two things. Does your method of reducing churn work? Did you break something by accident?

Churn rate is a godsend for any subscription-based business. It’s used by telecom companies to see if enough people are using their phone services. SaaS companies use it to check if their user base is growing and if users see value in the software.

If you want your subscription-based business to grow, the number of customers you get every month needs to be higher than the number of customers who churn.

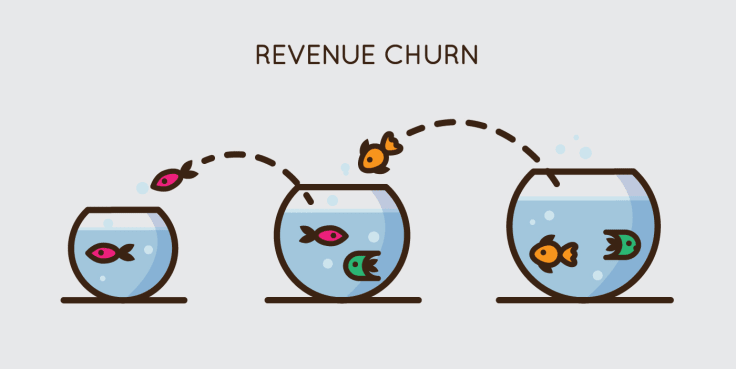

Defining revenue churn rate

The customer churn rate is not the only metric to follow. Apart from checking how many customers you lose over time, check how much revenue you lose.

Not every dissatisfied customer has to leave immediately. They can switch to a lower plan or use your product to a lesser degree instead. This leads to a smaller amount of revenue you get from that customer or, in other words, a lower customer lifetime value (LTV).

In this situation, you don’t lose customers, but you still see that you’re earning less. You're down the rabbit hole. You're getting more and more customers, and your churn goes down, but your revenue seems to stay the same.

If you see that your revenue churn rate starts to increase, it’s an early sign that users don’t see enough value in the plan they are using and switch to cheaper plans or cancel the service. Alternatively, this can also mean that your new customers subscribe to more affordable plans, but your existing customers paying for the more expensive ones start to churn.

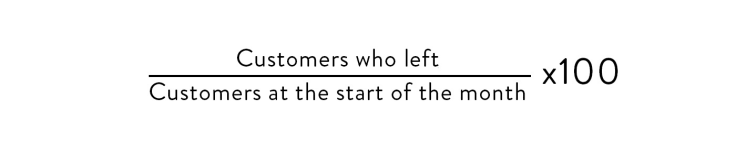

Churn rate formula

To calculate churn rate for a given month, check how many customers you have at the start of the month. Then, take a look at how many of those customers leave by the end of the month. Once you have both numbers, divide the number of churned customers by the number of customers at the start of the month to get your basic churn rate. Multiply it by 100 to get a percentage.

This method is the most basic approach to measuring a month-to-month churn rate. You can also calculate your annual churn rate in the same way. Look at the number of customers at the start of the year, and, then, check how many customers left during that year.

Most subscription-based businesses allow for a minimal subscription of one month. If your company offers weekly subscriptions, for instance, add new customers who churned to that metric at the end of each week.

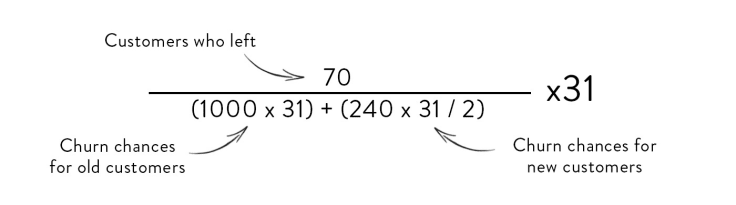

Recurly proposed an alternative way to calculate churn. Count the number of chances a customer had to leave and check how many times he used them. This method will allow you to check the churn for each day separately, and it will provide more precise data than checking your monthly churn rate.

You start in the same way. Check how many customers you had at the start of the month. Then, multiply that number by the number of days in that month. The number you get will be all the chances your customers had to leave. One day for one customer equals one chance to leave.

In this case, we will also consider new customers. See how many new customers you gained, multiply it by the number of days in the month, and divide it by two. Since these customers won’t have as many chances to leave, we need to limit the number of their churn chances a bit. We assume that, on average, a new customer will be using your product for half a month. Hence, we divide the number of churn chances by two.

Once you have both numbers, add them up. Now, divide the number of customers who left this month by the number of churn chances. The result will be the churn rate for one day. Multiply it by the number of days in a month to get the churn rate for that month.

In this example, we have a company that started in March (31 days) with 1000 customers and gained 240 new customers. Seventy customers left during those 31 days. Out of 34,720 churn chances, 70 customers used the opportunity. This gives us a 6.25% monthly churn rate for the company. You need to multiply it by 100 if you want to get the percentage value.

Segmenting churn rate

No matter which method you are using to calculate your churn rate, you need to dig deeper if you want more precise results.

One way to do that is segmentation. Instead of looking at all of your customers or total revenue, take a look at customers for specific plans. This also works for revenue: Look at the revenue gained from monthly and annual renewals separately.

It’s still not a specific number, but it’s a lot more precise than throwing everything together. Use separate churn metrics for different plans, different volumes, and different lengths of the subscription.

Factors affecting churn rate

Churn rate allows you to look at the immediate results of your actions. How much of it can be attributed to different factors is a whole new ball game. You can never say that an increase in churn is a result of this or that. It’s always, more or less, an educated guess.

Some of the basic factors that may influence churn rate are:

- Customer satisfaction. The more satisfied customers are with your service, the less likely they are to leave when something goes wrong.

- Customer delight. It looks similar to good customer service, but it’s a lot more difficult to get. It’s the measure of going the extra mile and providing something extra for the customer.

- Switching costs. The more expensive it is to move to a competitor, the less likely a customer is to move. This counts for both the implementation costs as well as staff training costs.

- Value. If you fail to show enough value to customers, they won’t be able to justify paying for your product.

When working with these factors, it’s hard to say what you should consider an acceptable level of churn. Depending on the type of industry you’re in or the customer base you have (B2C vs. B2B), the optimal churn rates will vary.

There’s one golden rule that applies to all companies, though. A negative churn rate is your end goal. It’s the magical ‘Neverland’ you want to reach with your churn reduction efforts. It's nearly impossible with the number of customers. It's a lot more doable with revenue, but it’s still complicated.

How to decrease the churn rate

We tried multiple ways of decreasing churn at LiveChat over the years. Some of them worked out better, some worse. And some of them didn’t work for us at all.

We learned that fixing churn rate is a process. You can even call it a collection of processes. Here are a few tested methods that worked for us:

1. Recurring payments

Making sure that payments renew reliably will be one of the biggest game-changers in terms of reducing customer churn you can get. We’re currently using Recurly to make sure that our customers can automatically renew their licenses at the end of each billing cycle.

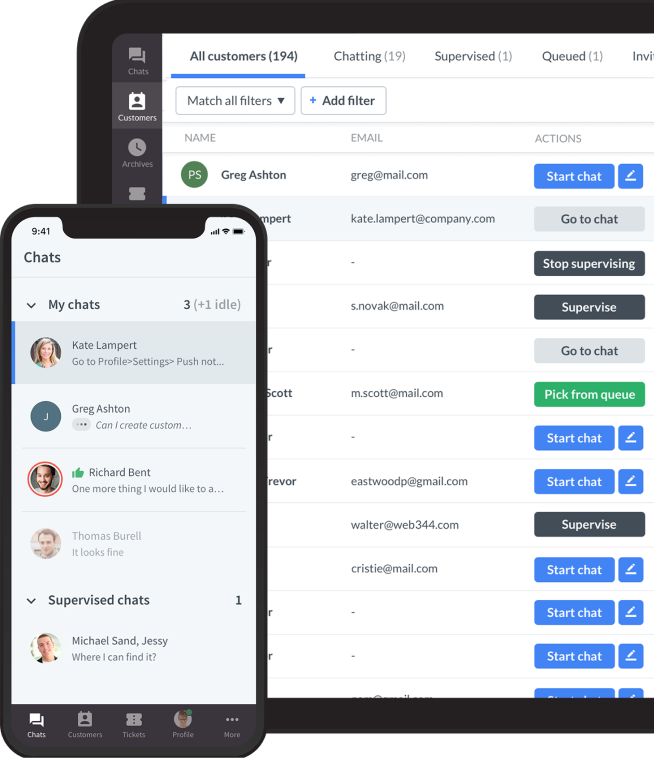

This may seem like a small thing, but it makes a big difference by reducing the number of steps a customer needs to take. We used to have hundreds of chats each month from customers who wanted us to handle various billing matters. Since implementing the automatic payment renewal, the number of these cases decreased to only a couple of chats each month.

2. Reminder emails

Reminding users when their subscription is about to expire is another excellent way to make sure there are no holes in your revenue. A simple email stating that a user’s account will expire in a couple of days will be enough to get some businesses to add their credit card details and make a payment.

To give you an idea of the effectiveness of these emails, around 80% of customers who get them, renew their licenses.

We found out how successful this method is when we sent a reminder like that by mistake to all our customers a couple of years ago. Most customers had already paid for their licenses. Many of them still came to our website to make sure their payments went through and that they didn’t need to renew them yet.

3. Increasing the dunning period

Another simple fix for your churn rate is adjusting the dunning period. That’s the time period in which a payment gateway will try to process a customer’s payment. It’s usually a set number of days after which the payment gateway will stop trying to process the payment and then will mark the customer’s account as expired.

We set it to nine days initially. By adjusting it just a bit and adding three more days, we saw a 15% increase in the number of customers who eventually made a payment after it was first rejected.

4. Fixing the potential problems of our customers

As mentioned above, customers have to see value in your product. If something is standing in the way of that value, you can try to help the customer remove those obstacles by providing extra services and knowledge.

In the case of LiveChat, there are two potential problems new customers might face. First, they need traffic. Without traffic, they won’t get chats. Second, they need someone to handle the chats. Without these two things, our customers won’t see value in LiveChat.

To help our customers find value, we supply them with the knowledge they can use to get more traffic. Through various guides and blog articles, we show them how to draw more traffic to their sites. For customers who already have traffic but don’t have the necessary staff, we created the Experts Marketplace. It's a service that allows them to find individuals or businesses that can provide support outsourcing services.

5. Extended onboarding via marketing automation

If you’re doing marketing automation, use it to decrease your churn rate. It’s one of the more scaleable methods because it doesn’t require a lot of oversight once you set it up.

Keep pointing the customer in the right direction even after the onboarding process ends. Don't stop providing knowledge or helpful tips after somebody becomes a customer. By showing customers different parts of your product and teaching them how they should use it, you can prematurely solve a lot of potential problems.

What didn’t help us decrease churn rate

One of the things that didn’t work for us is using a scoring system to determine the ‘health’ of individual customers.

A scoring system helps you decide which customers need some extra attention based on several predetermined factors. Whenever a user performs a specific, desired action, they are assigned a set amount of points. For example, they get some points when they start using a particular feature in your software. The more points they have, the healthier your relationship with the customer is.

This is based on the assumption that a customer with a perfect score will never want to leave your business because they are getting so much value from it. And, the more points they have, the more value they saw.

That’s the idea anyway. It makes a lot of sense on paper, but we found it very hard to decide on the factors we should include in the scoring system. The sheer number of customers we have made it very hard to find that perfect scenario. Our customers come up with new ideas on how to use LiveChat almost daily, and it’s hard to frame all of them with a couple of predetermined factors.

As a result, we had a lot of weird situations. We had customers with high scores leaving without any apparent reason. In other instances, businesses that should churn out (based on the number of points they had), continued to use LiveChat for months.

How do we plan to decrease the churn rate in the future

We want to do even more to combat customer churn rate. We want to start doing regular health checks on our customers. The plan is to have one of our Customer Success Managers reach out to customers via chat or email and make sure that everything is going fine on the customer's side.

We also plan to segment these health checks a bit. We want to switch to making calls with customers that bring more revenue. There are far fewer of these customers, so calling them is much more doable than trying to call every customer.

That's what we’re planning to do right now. I’m sure we’ll want to test plenty of other ideas to combat our churn rate. Since churn is not something you want to leave for later, I’m sure you will want to do the same in your business.

What is the current state of customer or revenue churn in your company? Are you doing anything to deal with it? What worked in your case? We’d be happy to know because you never have too many good ideas to test out when it comes to decreasing customer churn.

Get a glimpse into the future of business communication with digital natives.

Get the FREE report

Comments