Showing top 0 results 0 results found

Showing top 0 results 0 results found

In the business world, numbers speak volumes, especially regarding key performance indicators (KPIs). They are a roadmap for your business's success, helping you measure important aspects like sales, customer satisfaction, and efficiency. Without KPIs, it's like driving blindfolded—you might get somewhere, but you're more likely to hit obstacles along the way.

So, by regularly calculating and analyzing KPIs, you’re steering your business towards growth and prosperity. Here’s why that matters:

- Clarity: KPIs clearly show how well your customer support team meets customer needs and expectations. Whether you measure customer satisfaction scores, retention rates, or response times, KPIs provide tangible metrics that indicate whether customers are happy and engaged.

- Accountability: KPIs ensure that everyone in the organization understands their responsibilities toward customer success. When employees have clear customer success metrics to work towards, they feel accountable for delivering results, ultimately driving a customer-centric culture.

- Continuous improvement: By regularly tracking and analyzing customer success KPIs, businesses can identify areas where they excel and need to improve. This allows them to make data-driven decisions and implement a customer success strategy that enhances customer experience.

This article covers the customer success metrics that will give you clear signals about what's working, what's not, and which areas require improvement.

Most important customer success KPIs

1. Customer feedback metrics

Customer feedback metrics show how customers perceive a company's products, services, and overall brand experience. By examining these metrics more closely, businesses can spot areas for improvement, gauge customer loyalty, and make smarter strategic choices.

Net promoter score (NPS)

NPS represents the loyalty and advocacy of customers towards your company, product, or service. It shows you how loyal your clients are, which are your fans/promoters, and which drive potential customers away from your brand.

How to measure NPS

Start with a net promoter score survey consisting of one question: “How likely are you to recommend X to a friend or family?” Customers respond on a scale of 0-10 and are then classified into three categories based on their likelihood to recommend:

- Promoters (score of 9-10): Loyal clients who are very likely to recommend a company to others, contributing positively to brand advocacy and growth.

- Passives (score of 7-8): Satisfied but indifferent customers who may not actively promote the company but are unlikely to speak negatively about it either.

- Detractors (score of 0-6): Unhappy customers who are likely to discourage others from buying from the company, posing a risk to reputation and growth.

NPS is calculated by subtracting the percentage of detractors from the percentage of promoters. A high NPS indicates your customers are satisfied and more likely to be loyal to your brand, which can lead to positive word-of-mouth and business growth.

NPS = % Promoters % Detractors

The net promoter score can range between -100% to +100%, with higher scores indicating more promoters than detractors.

Example

If 30% of your clients are detractors, 10% are passives, and 60% are promoters, your NPS would be +30%.

Customer satisfaction score (CSAT)

CSAT measures the satisfaction level of customers with a specific interaction, transaction, or experience with a company.

How to measure CSAT

Customers are asked to rate their satisfaction with a product, service, or interaction using a numerical scale (commonly 1-5 or 1-10). A high CSAT indicates happy customers who are likely to continue doing business with you and may become advocates for your brand.

- A customer satisfaction score of 4 or 5 out of 5 indicates high satisfaction, meaning customers are pleased with their experience and likely to return.

- A customer satisfaction score of 3 suggests moderate satisfaction, indicating that customers are somewhat satisfied but may have some concerns or areas for improvement.

- Scores below 3 indicate low satisfaction, signaling that customers are dissatisfied with their experience and may not return or recommend the company to others.

The average customer satisfaction score across respondents determines the CSAT.

Example

If a survey of customers' satisfaction with a recent purchase yields an average score of 4.5 out of 5, the CSAT for that interaction is 90%.

Customer effort score (CES)

CES measures the ease of a customer's experience when interacting with your company, like making a purchase, resolving an issue, or seeking assistance.

How to measure CES

Customers are asked to rate the level of effort required to complete a specific task or interaction, often on a 5-level scale ranging from "very easy" to "very difficult."

- A score of 4 or 5 out of 5 (or equivalent) indicates that customers find the experience effortless and convenient, increasing the likelihood of satisfaction and loyalty.

- A score of 3 indicates that customers find the experience somewhat inconvenient but are still relatively satisfied.

- Scores below 3 indicate high effort, signaling that customers encounter significant challenges or obstacles in the interaction, which may lead to frustration and dissatisfaction.

The average score across respondents is calculated to determine the CES.

Example

If a survey of customers' efforts in resolving an issue yields an average score of 4 out of 5 (where 5 indicates “very easy”), the CES for that interaction is 80%.

2. Financial metrics

Financial metrics allow you to grasp your company's fiscal standing, performance, stability, and growth trajectory. Knowing these customer success KPIs lets you make informed decisions, identify optimization opportunities, and understand your weaknesses.

Customer lifetime value (CLV)

CLV represents the total revenue a company can expect from a single customer over the entirety of its relationship with the business. It demonstrates the long-term value of acquiring and retaining customers and helps you prioritize the resources and investments to acquire and retain high-value customers.

How to measure CLV

The formula for calculating the customer lifetime value varies based on the specific method, but it typically involves multiplying average purchase value, purchase frequency, and customer lifespan. The result is expressed in monetary terms (dollars) and usually calculated over a specific period (annually). A higher customer lifetime value indicates that customers are valuable assets to the company and contribute significantly to revenue generation.

Example

If the average purchase value is $50, the average purchase frequency rate is 2 times per month, and the average customer lifespan is 5 years:

CLV = $50 x 2 x 12 x 5 = $6,000.

This means you can expect to make $6,000 from a single customer.

Customer acquisition cost (CAC)

CAC scores represent the efficiency and effectiveness of a company's marketing and sales efforts in acquiring new customers.

How to measure CAC

CAC is calculated by dividing the total costs of acquiring customers (marketing expenses, sales salaries, etc.) by the number of new customers acquired within a specific period. It’s expressed in monetary terms (dollars) and calculated over a specific period (monthly, annually, etc.). Lower CAC indicates that your company is acquiring customers at a lower cost, which is desirable for profitability and growth.

CAC = Total costs of acquisition / number of new customers acquired

Example

If your company spends $10,000 on marketing and sales efforts in a month and acquires 100 new customers:

CAC = $10,000 / 100 = $100 per customer.

This means your company has spent $100 this month for each new customer.

Monthly recurring revenue (MRR)

MRR represents the predictable and recurring revenue generated from subscription-based products or services every month. It provides insight into your business’s financial stability and growth potential.

How to measure MRR

The monthly recurring revenue is calculated by summing up the monthly subscription fees from all active customers or subscribers. It’s expressed in monetary terms (dollars) and calculated monthly. Increasing MRR indicates growth in the company's subscription business and overall financial health.

Example

If a company has 500 active subscribers, each paying $50 per month:

MRR = 500 x $50 = $25,000 per month.

Average revenue per account (ARPA)

ARPA represents the average revenue generated per account or customer. It provides insights into the revenue-generating potential of individual customers or accounts.

How to measure ARPA

ARPA is calculated by dividing the total revenue generated by all customers by the total number of customers or accounts. It’s expressed in monetary terms (dollars) and usually calculated over a specific period (monthly, annually, etc.).

ARPA = Total revenue / Total number of customers or accounts

A higher ARPA indicates that customers spend more with the company, contributing to higher overall revenue.

Example

If a company generates $100,000 in revenue from 1,000 customers:

ARPA = $100,000 / 1,000 = $100 per customer.

Customer retention cost (CRC)

CRC represents the total cost incurred by a company to retain existing customers. It provides insights into the resources allocated to customer retention efforts.

How to measure CRC

CRC is calculated by dividing the total costs associated with customer retention efforts (loyalty programs, customer support, etc.) by the total number of retained customers within a specific period.

CRC = Total costs of retention / Number of retained customers

A lower CRC indicates that you’re retaining customers at a lower cost, which benefits profitability and growth.

Example

If a company spends $5,000 on customer retention efforts in a month and retains 500 customers:

CRC = $5,000 / 500 = $10 per retained customer.

Net retention rate (NRR)

The NRR measures the revenue growth or decline, accounting for both churn and expansion revenue. It indicates the company's ability to retain and grow revenue from existing customers.

How to measure NRR

NRR is calculated by subtracting the revenue lost from churned customers from the revenue gained from customers who expand their purchases, divided by the revenue at the beginning of the period. It’s expressed as a percentage.

NRR = (Revenue from existing customers + revenue lost from churned customers / revenue at the beginning of the period) 100

A positive NRR (higher than 100%) indicates revenue growth from existing customers, while a negative NRR (lower than 100%) indicates revenue decline.

Example

If a company starts with $1,000,000 in revenue, gains $50,000 from customers who expand their purchases, and loses $20,000 from churned customers:

NRR = ($1,000,000 + $50,000 $20,000) / $1,000,000) 100 = 103%.

3. Retention metrics

Retention metrics serve as a compass to keep customers engaged and loyal. These customer success metrics provide valuable insights into customer behavior, satisfaction, and loyalty, helping you implement strategies that nurture lasting relationships and foster long-term success.

Churn rate

The customer churn rate measures the rate customers stop doing business with your company over a specific period. It indicates customer attrition and is essential for assessing customer satisfaction and loyalty.

How to measure the churn rate

The customer churn rate is calculated as a percentage by dividing the number of customers lost during a specific period by the total number of customers at the beginning of that period.

Churn rate = (Number of customers lost during period / total number of customers at the beginning of period) 100

A higher customer churn rate indicates that more customers are abandoning your brand, which can negatively impact revenue and growth.

Example

If a company loses 50 customers out of 500 at the beginning of the quarter:

Churn rate = (50 / 500) 100 = 10%.

Customer retention rate

Customer retention rate measures the percentage of customers a company retains over a specific period. It reflects the ability to keep customers engaged and satisfied.

How to measure the customer retention rate

The customer retention rate is calculated by subtracting the number of customers lost during a specific period from the total number of customers at the beginning, dividing by the total number of customers at the start of the period, and multiplying by 100. It’s expressed as a percentage.

Customer retention rate = (Number of customers at the end of period + number of customers lost during period) / number of customers at the beginning of period) 100

Higher retention rates indicate stronger customer loyalty and satisfaction.

Example

If a company starts with 500 customers, loses 50 customers, and retains 450 customers at the end of the quarter:

Customer retention rate = (450 + 50) / 500) x 100 = 80%.

Renewal rate

Renewal rate scores represent the percentage of customers who continue their relationship with your company by renewing their subscriptions, contracts, or services. It reflects customer satisfaction and the effectiveness of renewal strategies.

How to measure the renewal rate

The renewal rate is calculated by dividing the number of customers who renew their subscriptions, contracts, or services by the total number of customers eligible for renewal, multiplied by 100.

Renewal rate = (Number of renewals / total number of customers eligible for renewal) x 100

Higher renewal rates indicate strong customer satisfaction and loyalty.

Example

If a company has 300 customers eligible for renewal and 250 of them renew their subscriptions:

Renewal rate = (250 / 300) x 100 = 83.33%.

Net retention rate

Net retention rate (NRR) measures the revenue growth or decline from existing customers, accounting for both churn and expansion revenue. It shows your company's ability to retain and grow revenue from customers.

How to measure NRR

NRR is calculated as a percentage by subtracting the revenue lost from churned customers from the revenue gained from customers who expand their purchases, divided by the revenue at the beginning of the period.

NRR = (Revenue from existing customers - revenue lost from churned customers) / revenue at the beginning of the period) x 100

A positive NRR (higher than 100%) indicates revenue growth from existing customers, while a negative NRR (lower than 100%) indicates revenue decline.

Example

If a company starts with $1,000,000 in revenue, gains $50,000 from customers who expand their purchases, and loses $20,000 from churned customers:

NRR = ($1,000,000 - $50,000 $20,000) / $1,000,000) x 100 = 103%.

4. Usage and engagement metrics

Usage and engagement metrics offer insight into customer behavior, patterns of interaction, preferences, and areas of interest. By analyzing these customer success metrics, you can tailor your products or services to better meet your customer’s needs, enhance engagement, and foster stronger relationships. Here are the main user and engagement KPIs:

Average time on platform

Average time on platform measures the average duration users spend on a platform or website during a specific period. It indicates user engagement and the stickiness of the platform.

How to measure the average time on platform

Average time on platform is calculated by dividing the total time users spend on the platform by the total number of users.

Average time on platform = (Total time spent by users / total number of users)

Higher average times indicate higher user engagement and satisfaction with the platform's content or services. Lower time means visitors leave the platform quickly, requiring improvement.

Example

If 100 users spend a total of 1,000 hours on a platform:

Average Time on Platform = (1,000 hours / 100 users) = 10 hours/user.

First contact resolution rate (FCRR)

The FCRR measures the percentage of customer inquiries or issues resolved during their initial contact with your customer support or service representatives. It reflects the efficiency and effectiveness of customer service operations.

How to Measure FCRR

FCRR is calculated as a percentage by dividing the number of customer inquiries or issues resolved during their initial contact by the total number of customer inquiries or issues multiplied by 100.

First contact resolution rate = (Number of inquiries resolved on first contact / total number of inquiries) x 100

Higher FCRR indicates efficient and effective customer service operations.

Example

If 80 out of 100 customer inquiries are resolved during their initial contact:

FCRR = (80 / 100) x 100 = 80%.

Free trial conversion rate (CR)

The CR measures the percentage of users who convert from a free trial to a paid subscription or service. It indicates the effectiveness of free trial offers in acquiring paying customers.

How to measure CR

The CR is calculated by dividing the number of users who convert from a free trial to a paid subscription by the total number of users who participated in the free trial, multiplied by 100. It’s expressed as a percentage.

Free trial conversion rate = (Number of conversions from free trial / total number of users in free trial) x 100

Higher conversion rates mean the free trial offers are effective in acquiring paying customers.

Example

If 50 out of 200 users who participated in a free trial convert to paid subscribers:

Free trial conversion rate = (50 / 200) x 100 = 25%.

Repeat purchase rate (RPR)

The RPR measures the percentage of customers who make more than one purchase over a specific period. It reflects customer loyalty and satisfaction with the product or service.

How to measure RPR

RPR is calculated by dividing the number of customers who make more than one purchase by the total number of unique customers, multiplied by 100.

Repeat purchase rate = (Number of customers with repeat purchases / total number of unique customers) x 100

A higher RPR indicates strong customer loyalty and satisfaction with the product or service.

Example

If 200 out of 500 unique customers make repeat purchases:

Repeat purchase rate = (200 / 500) x 100 = 40%.

Self-service rate (SSR)

The SSR measures the percentage of customer inquiries or issues resolved through self-service channels, such as FAQs, knowledge bases, or online tutorials. It reflects the effectiveness of your self-service channels in addressing customer needs.

How to measure SSR

SSR is calculated as a percentage by dividing the number of customer inquiries or issues resolved through self-service channels by the total number of customer inquiries or issues multiplied by 100.

Self-service rate = (Number of inquiries resolved through self-service / total number of inquiries) x 100

Higher SSR indicates the effectiveness of self-service options in addressing customer needs and reducing reliance on live support.

Example

If 300 out of 500 customer inquiries are resolved through self-service channels:

Self-service rate = (300 / 500) x 100 = 60%.

Product/service adoption rate (P/SAR)

The P/SAR measures the percentage of users or customers who adopt a new product or service over a specific period. It indicates how well they accept and use your latest offerings.

How to measure P/SAR

P/SAR is calculated by dividing the number of users or customers who adopt the new product or service by the total number of users or customers, multiplied by 100. It’s expressed as a percentage.

Product/service adoption rate = (Number of users or customers adopting new product/service / total number of users or customers) x 100

Higher adoption rates indicate successful introduction and acceptance of new offerings.

Example

If 500 out of 1,000 users adopt a new feature:

Product/service adoption rate = (500 / 1,000) x 100 = 50%.

Time to value (TTV)

TTV measures the time it takes for customers to derive value from a product or service after the initial interaction or purchase. It reflects the efficiency of onboarding processes and the effectiveness of delivering value to customers.

How to measure TTV

TTV is calculated by determining the time elapsed between the initial interaction or purchase of a product and when customers realize value from the product or service. It’s expressed in time units (days, weeks, months, etc.).

Time to value = Time elapsed between initial interaction/purchase and value realization

A shorter TTV indicates that customer gets the value from their purchase quickly after purchase.

Example

If customers start realizing value from a software product two weeks after the initial setup:

Time to Value = 2 weeks.

Active user rate (AUR)

AUR measures the percentage of users who regularly engage with a product or service over a specific period. It indicates user retention and the stickiness of the product or service.

How to measure AUR

AUR is calculated by dividing the number of active users (those who engage with the product or service) by the total number of users, multiplied by 100. It’s expressed as a percentage.

Active user rate = (Number of active users / total number of users) x 100

A higher AUR indicates strong user retention and active product or service usage.

Example

If 400 out of 1,000 users regularly engage with a mobile app:

Active user rate = (400 / 1,000) x 100 = 40%.

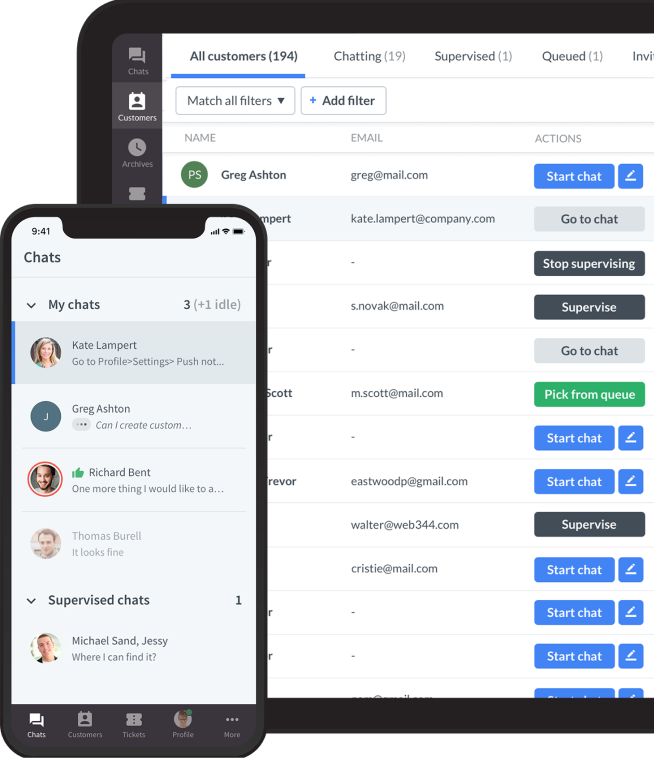

How a live chat service helps improve KPIs

Implementing a live chat service can significantly contribute to customer satisfaction, retention, and overall experience. The ability to respond quickly, efficiently, and with the correct information a customer wants can ultimately help you improve various customer success metrics and your business’s position. Here's how a live chat can help improve your customer success metrics:

- Increased CSAT: Live chat provides assistance the second a customer initiates the chat, resolving customer queries in real time. This efficient support increases customer satisfaction as customers feel valued and cared for. A satisfied customer is more likely to return for another purchase.

- Improved FCRR: Live chat agents are often trained to address customer issues quickly, boosting the FCRR and providing efficient customer service.

- Enhanced customer retention rate: Prompt and personalized support a live chat service provides creates a positive experience for customers, increasing the likelihood of them becoming your loyal customers and increasing the customer retention rate.

- Reduced CES: Live chat streamlines the support process, minimizing the effort required from customers to resolve their issues. Customers appreciate this convenience, leading to a decrease in CES as they find it easier to interact with the company.

- Higher conversion rates: You can strategically use live chat to engage website visitors as soon as they land on your website, address their concerns, and guide them through the purchase process. Live chat provides real-time assistance and personalized recommendations, helping increase conversion rates and drive sales.

- Faster response times: Unlike other support channels like email or phone, live chat offers quicker response times. This agility in addressing customer inquiries improves metrics related to average response time and customer wait times.

- Better understanding of customer needs: Live chat transcripts provide valuable insights into customer queries, pain points, and preferences. Analyzing these transcripts can help you identify common issues, optimize your products or services, and tailor your support strategies to address customer needs.

- Increased efficiency and productivity: Live chat enables support agents to handle multiple inquiries simultaneously, improving productivity and efficiency. This scalability allows businesses to manage customer interactions more effectively, resulting in better KPI performance.

Best practices for measuring and analyzing customer success metrics

Set SMART goals

Setting SMART (specific, measurable, achievable, relevant, time-bound) goals is essential for effective KPI measurement.

- Define specific, measurable, achievable, relevant, and time-bound goals for each KPI.

- Ensure the objectives are clearly and accurately defined to avoid confusion.

- Align KPI goals with organizational strategies to drive meaningful outcomes.

Data collection and analysis techniques

Effective data collection and analysis techniques are vital for accurate KPI measurement and making informed decisions.

- Identify and leverage relevant data sources, including customer feedback, sales data, and operational metrics, to measure customer success.

- Implement strong data collection methods and quality controls to ensure accuracy and reliability.

- Utilize data analysis techniques such as statistical and trend analyses to get actionable insights from KPI data.

Use tools and technologies for tracking KPIs

Effective KPI tracking requires the right tools and technologies. Here are some tools and technologies that can help you track your customer success metrics better:

- A KPI dashboard software to centralize and visualize key metrics in real time.

- Advanced analytics tools and predictive insights.

- KPI tracking functionality integrated into existing systems, such as data management CRM platforms.

Common challenges and how to overcome them

While measuring KPIs is crucial for success, businesses often face common challenges that can impede progress. Here are some of the most common ones:

- Misalignment between customer success KPIs and business objectives. Regularly review and adjust KPIs to ensure alignment with evolving business goals.

- Data quality issues. Implement data validation processes and invest in data cleansing tools to maintain data integrity.

- Resistance to change. Foster a culture of data-driven decision-making and provide training and support to encourage KPI measurement practices.

Conclusion

Customer success KPIs are important because they can align the entire organization toward a common goal: ensuring that customers achieve their desired outcomes. A business with insightful KPIs can navigate challenges and build strong, lasting relationships with its customers.

Comments